does texas have state inheritance tax

There is a big exception to the no inheritance tax rule however. First there are the federal governments tax laws.

How To Find A Good Estate Planning Attorney Estate Planning Attorney Estate Planning Attorneys

There is also no inheritance tax in Texas.

. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. Texas also imposes a cigarette tax a gas tax and a hotel tax. Social Security benefits are not taxed by the state.

There is no federal inheritance tax but there is a federal estate tax. In Texas the median property tax rate is 1692 per. Who pays inheritance tax Texas.

That said you will likely have to file some taxes on behalf of the deceased including. Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. Virginia does not have an inheritance tax.

However if you live in Texas and have been gifted property as inheritance you may be surprised at how generous the state of Texas can be. E-file directly to the IRS. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

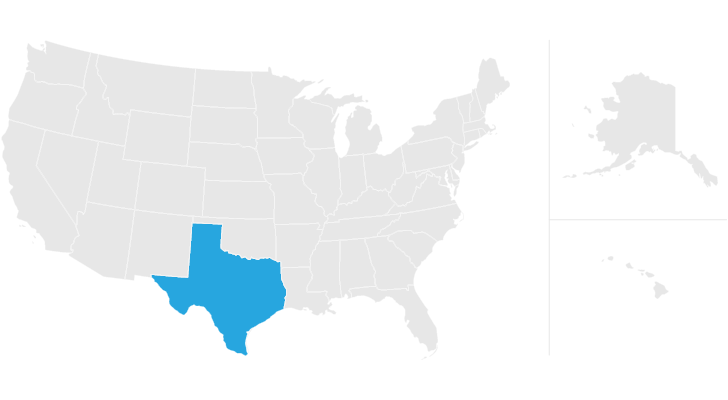

There are no inheritance or estate taxes in Texas. The chart below shows which states currently collect state individual income taxes state sales taxes state estate taxes state inheritance taxes andor state gift taxes. FEDERAL ESTATE TAX RATES Taxable Estate Base Taxes Paid Marginal Rate Rate Threshold 1 10000 0 18 1 10000 20000 1800 20 10000 20000 40000 3800 22 20000 40000.

Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if. Texas does not have a state estate tax or inheritance tax. Texas Inheritance Tax and Gift Tax.

However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. New Jersey Nebraska Iowa Kentucky and Pennsylvania.

Texas has no state income tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. It can sometimes seem like tax payments apply to whatever you do in life.

Twelve states and Washington DC. There are no inheritance or estate taxes in Texas. The state repealed the inheritance tax beginning on 9115.

In 2021 federal estate tax generally applies to assets over 117 million. The state of Texas does not have any inheritance of estate taxes. The final federal and state tax returns as well as the federal estatetrust income tax return are all due by tax day of the year following your death.

Texas does not have state estate taxes but Texas is subject to federal estate taxes. FreeTaxUSA FREE Tax Filing Online Return Preparation E-file Income Taxes. Note that local governments at the county or city level may collect one even if the state does not.

There are 12 states that have an estate tax. The short answer is no. Pennsylvania has a tax that applies to out-of-state inheritors for example.

While Texas doesnt have an estate tax the federal government does. Texas Have Inheritance Tax. As you might have guessed that can often be the case with the purchase sale and even gifting of property.

Each are due by the tax day of the year. Impose estate taxes and six impose inheritance taxes. That tax goes to the US.

Spouses and certain other heirs are typically excluded by states from paying inheritance taxes. - scrolls down to website information. The state repealed the inheritance tax beginning on September 1 2015.

There is a 40 percent federal tax however on estates over 534 million in value. Can be used as content for research and analysis. There is a 40 percent federal tax however on estates over 534 million in value.

Taxes on Social Security. Just five states apply an inheritance tax. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

Do it for free. There are not any estate or inheritance taxes in the state of Texas. Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate.

The state of Texas does not have an inheritance tax. Theres no personal property tax except on property used for business purposes. Final individual federal and state income tax returns.

Texas has no income tax and it doesnt tax estates either. Its inheritance tax was repealed in 2015. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

What are the estate tax rates in Texas. Does Texas Have an Inheritance Tax or Estate Tax. Maryland is the only state to impose both.

Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island. Overview of State Taxes in a Chart. However other stipulations might mean youll still get taxed on an inheritance.

Someone will likely have to file some taxes on your behalf after your death though including the following. Kentucky for example taxes inheritances at up to 16 percent. These federal estate taxes are paid by the estate itself.

Maryland is the lone state that. The sales tax is 625 at the state level and local taxes can be added on. Collected from the entire web and summarized to include only the most important parts of it.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

There is a 40 percent federal tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Federal 0 State 1499.

In Texas as well as nationwide if you are a named beneficiary of an individual retirement arrangement commonly referred to as an IRA then your share of the distribution is added to your ordinary income and will be taxed at your personal income tax rate. Income Tax Range.

0 Grant Road Cypress Tx 77429 Texas Real Estate Real Estate Sale House

Texas Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Texas Estate Tax Everything You Need To Know Smartasset

The Ultimate Estate Planning Checklist Asecurelife Com Estate Planning Checklist Estate Planning Funeral Planning Checklist

How Do Property Taxes In Texas Work Houston Texas Texas Property Tax

Low Tax States Are Often High Tax For The Poor Itep

Which Us States Tweet The Most About Tesla Data Dataviz Gluuio Tesla Infographic Piktochart U S States Texas Usa Data

States That Won T Tax Your Retirement Distributions Retirement Money Retirement Retirement Income

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Retirement Retirement Advice

Texas Income Tax Calculator Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Debt Relief Programs

What Are The Inheritance Laws In Texas Republic Of Texas Inheritance Texas

The 10 Most Miserable States In America States In America Wyoming America

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations